-

Notifications

You must be signed in to change notification settings - Fork 9

Blockchain

"Can Great Satoshi create a block so big that even he can’t propagate it?" 🤔

Bitcoin consists of:

- A decentralized peer-to-peer network (the bitcoin protocol)

- A public transaction ledger (the blockchain)

- A set of rules for independent transaction validation and currency issuance (consensus rules)

- A mechanism for reaching global decentralized consensus on the valid blockchain (Proof-of-Work algorithm)

Bitcoin is a protocol that can be accessed using a client application that speaks the protocol. A “bitcoin wallet” is the most common user interface to the bitcoin system, just like a web browser is the most common user interface for the HTTP protocol.

Any system, such as a server, desktop application, or wallet, that participates in the bitcoin network by “speaking” the bitcoin protocol is called a bitcoin node.

Any bitcoin node that receives a valid transaction it has not seen before will immediately forward it to all other nodes to which it is connected, a propagation technique known as flooding.

Bitcoin addresses start with a 1 or 3. Like email addresses, they can be shared with other bitcoin users who can use them to send bitcoin directly to your wallet. There is nothing sensitive, from a security perspective, about the bitcoin address. It can be posted anywhere without risking the security of the account. Unlike email addresses, you can create new addresses as often as you like, all of which will direct funds to your wallet. In fact, many modern wallets automatically create a new address for every transaction to maximize privacy. A wallet is simply a collection of addresses and the keys that unlock the funds within.

In most wallets, there is no association between the bitcoin address and any externally identifiable information including the user’s identity.

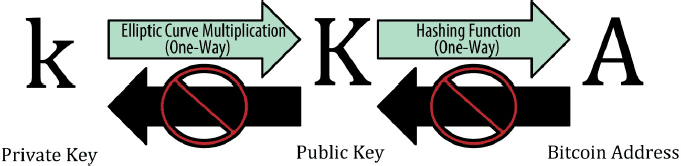

A bitcoin address is a string of digits and characters that can be shared with anyone who wants to send you money. Addresses produced from public keys consist of a string of numbers and letters, beginning with the digit “1”.

1J7mdg5rbQyUHENYdx39WVWK7fsLpEoXZy

Starting with the public key K, we compute the SHA256 hash and then compute the RIPEMD160 hash of the result, producing a 160-bit (20-byte) number:

A = RIPEMD160(SHA256(K))

A bitcoin address is not the same as a public key. Bitcoin addresses are derived from a public key using a one-way function.

| Type | Version prefix (hex) | Base58 result prefix |

|---|---|---|

| Bitcoin Address | 0x00 | 1 |

| Pay-to-Script-Hash Address | 0x05 | 3 |

| Bitcoin Testnet Address | 0x6F | m or n |

| Private Key WIF | 0x80 | 5, K, or L |

| BIP-38 Encrypted Private Key | 0x0142 | 6P |

| BIP-32 Extended Public Key | 0x0488B21E | xpub |

Multisignature scripts set a condition where N public keys are recorded in the script and at least M of those must provide signatures to unlock the funds.

The bitcoin multi-signature feature is designed to require M signatures (also known as the “threshold”) from a total of N keys, known as an M-of-N multisig, where M is equal to or less than N.

This would be similar to a “joint account” as implemented in traditional banking where either spouse can spend with a single signature.

2-of-3 multisignature address for his business that ensures that no funds can be spent unless at least two of the business partners sign a transaction.

The “wallet” refers to the data structure used to store and manage a user’s keys.

A common misconception about bitcoin is that bitcoin wallets contain bitcoin. In fact, the wallet contains only keys. The “coins” are recorded in the blockchain on the bitcoin network. Users control the coins on the network by signing transactions with the keys in their wallets. In a sense, a bitcoin wallet is a keychain.

In a nondeterministic wallet each key is independently generated from a random number. The keys are not related to each other. This type of wallet is also known as a JBOK wallet from the phrase “Just a Bunch Of Keys.”

The use of nondeterministic wallets is discouraged for anything other than simple tests. They are simply too cumbersome to back up and use.

In a deterministic wallet all the keys are derived from a single master key, known as the seed. All the keys in this type ofwallet are related to each other and can be generated again if one has the original seed.

Mnemonic code words are word sequences that represent (encode) a random number used as a seed to derive a deterministic wallet. The sequence of words is sufficient to re-create the seed and from there re-create the wallet and all the derived keys.

Mnemonic words are often confused with “brainwallets.” They are not the same. The primary difference is that a brainwallet consists of words chosen by the user, whereas mnemonic words are created randomly by the wallet and presented to the user.

Paper wallets are bitcoin private keys printed on paper. Often the paper wallet also includes the corresponding bitcoin address for convenience, but this is not necessary because it can be derived from the private key. Paper wallets are a very effective way to create backups or offline bitcoin storage, also known as “cold storage”.

Bitcoin is the authoritative ledger of all transactions.

Bitcoin transactions are irreversible. Most electronic payment networks such as credit cards, debit cards, PayPal, and bank account transfers are reversible.

Transaction outputs are indivisible chunks of bitcoin currency, recorded on the blockchain, and recognized as valid by the entire network. Bitcoin full nodes track all available and spendable outputs, known as unspent transaction outputs, or UTXO. The collection of all UTXO is known as the UTXO set and currently numbers in the millions of UTXO. The UTXO set grows as new UTXO is created and shrinks when UTXO is consumed. Every transaction represents a change (state transition) in the UTXO set.

Transaction outputs consist of two parts:

- An amount of bitcoin, denominated in satoshis, the smallest bitcoin unit

- A cryptographic puzzle that determines the conditions required to spend the output

The concept of a balance is created by the wallet application. The wallet calculates the user’s balance by scanning the blockchain and aggregating the value of any UTXO the wallet can spend with the keys it controls.

When we say that a user’s wallet has “received” bitcoin, what we mean is that the wallet has detected a UTXO that can be spent with one of the keys controlled by that wallet. Thus, a user’s bitcoin “balance” is the sum of all UTXO that user’s wallet can spend.

The coinbase transaction is the first transaction in each block. This transaction is placed there by the “winning” miner and creates brand-new bitcoin payable to that miner as a reward for mining. This special coinbase transaction does not consume UTXO; instead, it has a special type of input called the “coinbase.”

Strictly speaking, outputs come first because coinbase transactions, which generate new bitcoin, have no inputs and create outputs from nothing.

Bitcoin transaction validation is not based on a static pattern, but instead is achieved through the execution of a scripting language. This language allows for a nearly infinite variety of conditions to be expressed. This is how bitcoin gets the power of “programmable money.”

The bitcoin transaction script language is not Turing Complete, there are no loops or complex flow control capabilities other than conditional flow control.

There is no way that Bitcoin could possibly scale to being a general utility. At 1 MB per block, the blockchain can only do a maximum of 7 transactions per second, worldwide total!

Most transactions include transaction fees, which compensate the bitcoin miners for securing the network. Fees also serve as a security mechanism themselves, by making it economically infeasible for attackers to flood the network with transactions.

Transaction fees are not mandatory, and transactions without fees might be processed eventually; however, including transaction fees encourages priority processing.

For example, if you consume a 20-bitcoin UTXO to make a 1-bitcoin payment, you must include a 19-bitcoin change output back to your wallet. Otherwise, the 19-bitcoin “leftover” will be counted as a transaction fee and will be collected by the miner

Mining nodes validate all transactions by reference to bitcoin’s consensus rules. Therefore, mining provides security for bitcoin transactions by rejecting invalid or malformed transactions.

Mining creates new bitcoin in each block, almost like a central bank printing new money. The amount of bitcoin created per block is limited and diminishes with time, following a fixed issuance schedule.

Mining uses electricity to solve a mathematical problem. A successful miner will collect a reward in the form of new bitcoin and transaction fees.

The “puzzle” used in bitcoin is based on a cryptographic hash and exhibits similar characteristics: it is asymmetrically hard to solve but easy to verify, and its difficulty can be adjusted. Finding such a solution, the so-called Proof-of-Work (PoW).

The cryptographic puzzle is also known as a locking script, a witness script, or a scriptPubKey.

A locking script is a spending condition placed on an output: it specifies the conditions that must be met to spend the output in the future. Historically, the locking script was called a scriptPubKey.

An unlocking script (called sometimes scriptSig) is a script that “solves,” or satisfies, the conditions placed on an output by a locking script and allows the output to be spent. Unlocking scripts are part of every transaction input. Most of the time they contain a digital signature produced by the user’s wallet from his or her private key.

The majority of transactions processed on the bitcoin network spend outputs locked with a Pay-to-Public-Key-Hash or “P2PKH” script. These outputs contain a locking script that locks the output to a public key hash, more commonly known as a bitcoin address. An output locked by a P2PKH script can be unlocked (spent) by presenting a public key and a digital signature created by the corresponding private key

The algorithm for Proof-of-Work involves repeatedly hashing the header of the block and a random number with the SHA256 cryptographic algorithm until a solution matching a predetermined pattern emerges. The first miner to find such a solution wins the round of competition and publishes that block into the blockchain.

New transactions are added to a temporary pool of unverified transactions maintained by each node. As miners construct a new block, they add unverified transactions from this pool to the new block and then attempt to prove the validity of that new block, with the mining algorithm (Proof-of-Work).

Transactions are added to the new block, prioritized by the highest-fee transactions first and a few other criteria. Each miner starts the process of mining a new block of transactions as soon as he receives the previous block from the network, knowing he has lost that previous round of competition. He immediately creates a new block, fills it with transactions and the fingerprint of the previous block, and starts calculating the Proof-of-Work for the new block. Each miner includes a special transaction in his block, one that pays his own bitcoin address the block reward plus the sum of transaction fees from all the transactions included in the block.

Each block mined on top of the one containing the transaction counts as an additional confirmation for a transaction. As the blocks pile on top of each other, it becomes exponentially harder to reverse the transaction, thereby making it more and more trusted by the network.

As the reward decreases over time and the number of transactions per block increases, a greater proportion of bitcoin mining earnings will come from fees. Gradually, the mining reward will be dominated by transaction fees, which will form the primary incentive for miners. After 2140, the amount of new bitcoin in each block drops to zero and bitcoin mining will be incentivized only by transaction fees.

Threshold the target - the goal is to find a hash that is numerically less than the target. If we decrease the target, the task of finding a hash that is less than the target becomes more and more difficult.

The Proof-of-Work target is a dynamic parameter that is periodically adjusted to meet a 10-minute block interval goal. In simple terms, the target is set so that the current mining power will result in a 10-minute block interval.

If the network is finding blocks faster than every 10 minutes, the difficulty increases (target decreases). If block discovery is slower than expected, the difficulty decreases (target increases).

P2SH means “pay to a script matching this hash, a script that will be presented later when this output is spent”.

In P2SH transactions, the locking script that is replaced by a hash is referred to as the redeem script because it is presented to the system at redemption time rather than as a locking script.

P2SH feature is the ability to encode a script hash as an address. For example, hashed and Base58Check-encoded as a P2SH address, becomes 39RF6JqABiHdYHkfChV6USGMe6Nsr66Gzw. Now, the owner can give this “address” to his customers and they can use almost any bitcoin wallet to make a simple payment, as if it were a bitcoin address. The 3 prefix gives them a hint that this is a special type of address, one corresponding to a script instead of a public key, but otherwise it works in exactly the same way as a payment to a bitcoin address.

P2SH addresses hide all of the complexity, so that the person making a payment does not see the script.

- Complex scripts are replaced by shorter fingerprints in the transaction output, making the transaction smaller.

- Scripts can be coded as an address.

- P2SH shifts the burden of constructing the script to the recipient, not the sender.

- P2SH shifts the burden in data storage for the long script from the output (which is in the UTXO set) to the input (stored on the blockchain).

Bitcoin is structured as a peer-to-peer network architecture on top of the internet.

All the peers are all equal, that there are no “special” nodes, and that all nodes share the burden of providing network services. The network nodes interconnect in a mesh network with a “flat” topology. There is no server, no centralized service, and no hierarchy within the network. Nodes in a P2P network both provide and consume services at the same time.

A new node must discover at least one existing node on the network and connect to it. The geographic location of other nodes is irrelevant; the bitcoin network topology is not geographically defined.

How does a new node find peers? The first method is to query DNS using a number of “DNS seeds,” which are DNS servers that provide a list of IP addresses of bitcoin nodes. Some of those DNS seeds provide a static list of IP addresses of stable bitcoin listening nodes. Some of the DNS seeds are custom implementations of BIND (Berkeley Internet Name Daemon) that return a random subset from a list of bitcoin node addresses collected by a crawler or a long-running bitcoin node.

Alternatively, a bootstrapping node that knows nothing of the network must be given the IP address of at least one bitcoin node, after which it can establish connections through further introductions.

If there is no traffic on a connection, nodes will periodically send a message to maintain the connection. If a node has not communicated on a connection for more than 90 minutes, it is assumed to be disconnected.

Full nodes are nodes that maintain a full blockchain with all transactions.

A full blockchain node verifies a transaction by checking the entire chain of thousands of blocks below it in order to guarantee that the UTXO is not spent, whereas an SPV node checks how deep the block is buried by a handful of blocks above it.

Simplified payment verification (SPV) method is used to allow them to operate without storing the full blockchain. These types of clients are called SPV clients or lightweight clients.

SPV nodes download only the block headers and do not download the transactions included in each block.

SPV verifies transactions by reference to their depth in the blockchain instead of their height. Whereas a full blockchain node will construct a fully verified chain of thousands of blocks and transactions reaching down the blockchain (back in time) all the way to the genesis block, an SPV node will verify the chain of all blocks (but not all transactions) and link that chain to the transaction of interest.

Nodes that implement SPV have weaker privacy than a full node. A full node receives all transactions and therefore reveals no information about whether it is using some address in its wallet.

Bloom filters are a way to reduce the loss of privacy.

Almost every node on the bitcoin network maintains a temporary list of unconfirmed transactions called the memory pool, mempool, or transaction pool. Nodes use this pool to keep track of transactions that are known to the network but are not yet included in the blockchain.

The blockchain data structure is an ordered, back-linked list of blocks of transactions. The blockchain can be stored as a flat file, or in a simple database. The Bitcoin Core client stores the blockchain metadata using Google’s LevelDB database. Blocks are linked “back,” each referring to the previous block in the chain.

The sequence of hashes linking each block to its parent creates a chain going back all the way to the first block ever created, known as the genesis block.

Although a block has just one parent, it can temporarily have multiple children. Each of the children refers to the same block as its parent and contains the same (parent) hash in the “previous block hash” field. Multiple children arise during a blockchain “fork,” a temporary situation that occurs when different blocks are discovered almost simultaneously by different miners.

The block header consists of three sets of block metadata. First, there is a reference to a previous block hash, which connects this block to the previous block in the blockchain. The second set of metadata, namely the difficulty, timestamp, and nonce, relate to the mining competition.

The third piece of metadata is the merkle tree root, a data structure used to efficiently summarize all the transactions in the block.

The primary identifier of a block is its cryptographic hash, a digital fingerprint, made by hashing the block header twice through the SHA256 algorithm.

A second way to identify a block is by its position in the blockchain, called the block height. The first block ever created is at block height 0 (zero).

A block’s block hash always identifies a single block uniquely. A block also always has a specific block height. However, it is not always the case that a specific block height can identify a single block. Rather, two or more blocks might compete for a single position in the blockchain.

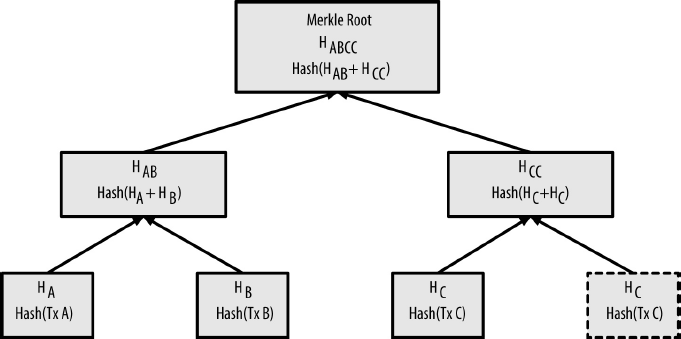

Each block in the bitcoin blockchain contains a summary of all the transactions in the block using a merkle tree.

A merkle tree, also known as a binary hash tree, is a data structure used for efficiently summarizing and verifying the integrity of large sets of data. Merkle trees are binary trees containing cryptographic hashes.

Merkle trees are used in bitcoin to summarize all the transactions in a block, producing an overall digital fingerprint of the entire set of transactions, providing a very efficient process to verify whether a transaction is included in a block.

It can be checked if any one data element is included in the tree with at most 2*log (N) calculations.

Duplicating one data element achieves an even number of data elements:

Merkle trees are used extensively by SPV nodes. SPV nodes don’t have all transactions and do not download full blocks, just block headers. In order to verify that a transaction is included in a block, without having to download all the transactions in the block, they use an authentication path, or merkle path.

Blocks might arrive at different nodes at different times, causing the nodes to have different perspectives of the blockchain. To resolve this, each node always selects and attempts to extend the chain of blocks that represents the most Proof-of-Work, also known as the longest chain or greatest cumulative work chain. By summing the work recorded in each block in a chain, a node can calculate the total amount of work that has been expended to create that chain. As long as all nodes select the greatest-cumulative-work chain, the global bitcoin network eventually converges to a consistent state.

Colored coins refers to a set of similar technologies that use bitcoin transactions to record the creation, ownership, and transfer of extrinsic assets other than bitcoin. By “extrinsic” we mean assets that are not stored directly on the bitcoin blockchain, as opposed to bitcoin itself, which is an asset intrinsic to the blockchain.

- Andreas M. Antonopoulos: Mastering Bitcoin

- https://coinmarketcap.com

- https://www.bitaddress.org

- Blockchain Demo: https://anders.com/blockchain

- Web 3.0 Explained

- David Gerard: Attack of the 50 Foot Blockchain

- In the Crypto Ecosystem, It’s Still 1968

- Stefan Tilkov: Achieving Consensus in Blockchain-based Systems

- Blockchain, the amazing solution for almost nothing