twelvedata provides a very rich REST API, see the documentation. While a (free) login and a (free, permitting limited but possibly sufficient use) API key are required, the provided access is rich to set up simple R routines. This package does that.

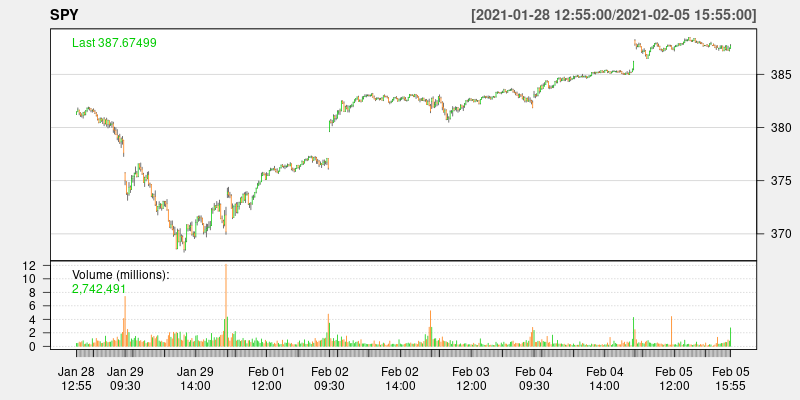

Here we are running (some) code from shown in example(time_series)

> library(td)

> data <- time_series("SPY", "5min", outputsize=500, as="xts")

> if (requireNamespace("quantmod", quietly=TRUE)) {

> suppressMessages(library(quantmod)) # suppress some noise

> chartSeries(data, name=attr(data, "symbol"), theme="white") # convenient plot for OHLCV

> }retrieves an xts object (provided xts is installed)

and produces a chart like this:

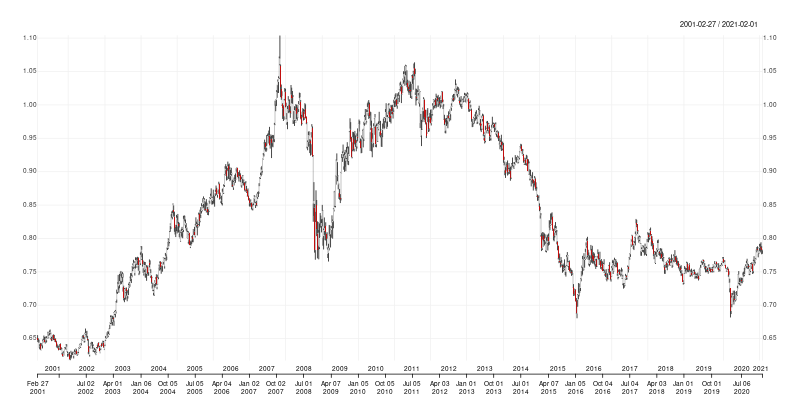

The package can also be used without attaching it. The next example retrieves twenty years of weekly

CAD/USD foreign exchange data using a direct td::time_series() call with having the package

loaded. The API key is automagically set (if it is in fact provided either in the user config file

or as an environment variable). Also shown by calling str() on the return object is the metadata

attach after each request:

> cadusd <- td::time_series(sym="CAD/USD", interval="1week", outputsize=52.25*20, as="xts")

> str(cadusd)

An ‘xts’ object on 2001-02-27/2021-02-01 containing:

Data: num [1:1045, 1:4] 0.651 0.646 0.644 0.638 0.642 ...

- attr(*, "dimnames")=List of 2

..$ : NULL

..$ : chr [1:4] "open" "high" "low" "close"

Indexed by objects of class: [Date] TZ: UTC

xts Attributes:

List of 6

$ symbol : chr "CAD/USD"

$ interval : chr "1week"

$ currency_base : chr "Canadian Dollar"

$ currency_quote: chr "US Dollar"

$ type : chr "Physical Currency"

$ accessed : chr "2021-02-06 15:16:29.209635"

> As before, it can be plotted using a function from package

quantmod; this time we use the newer

chart_Series():

> quantmod::chart_Series(cadusd, name=attr(data, "symbol"))As the returned is a the very common and well-understood [xts] format, many other plotting functions

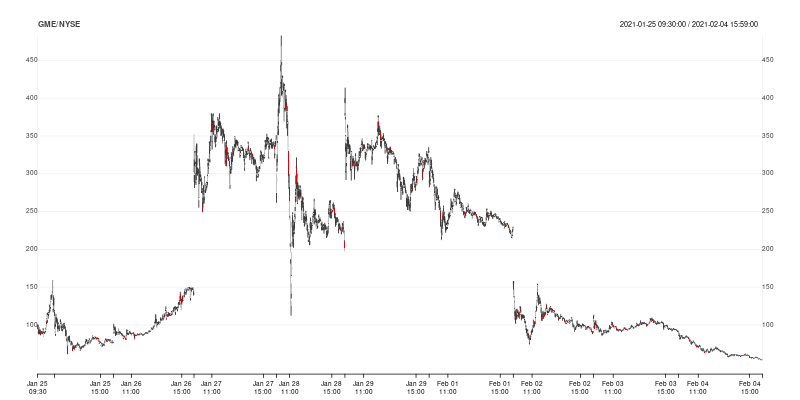

can be used as-is. Here is an example also showing how historical data can be accessed. We retrieve

minute-resolution data for GME during the late January / early February period:

> gme <- time_series("GME", "1min",

+ start_date="2021-01-25 09:30:00",

+ end_date="2021-02-04 16:00:00", as="xts")Note the use of exchange timestamps (NYSE is open from 9:30 to 16:00 local time).

We can plot this again using quantmod::chart_Series() showing how to display ticker symbol

and exchange as a header:

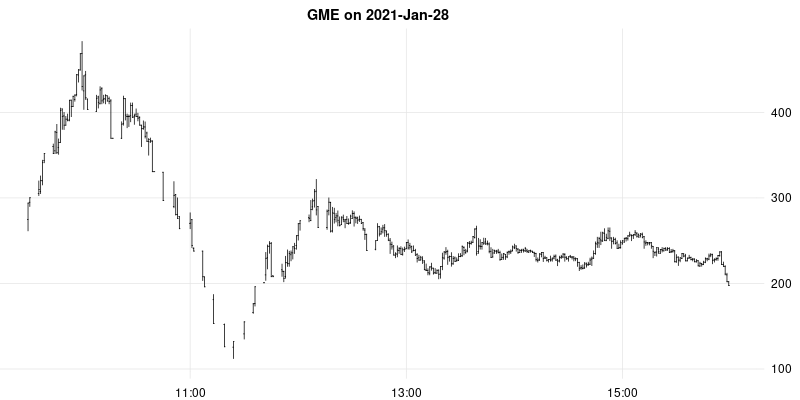

> quantmod::chart_Series(gme, name=paste0(attr(gme, "symbol"), "/", attr(gme, "exchange")))Naturally, other plotting functions and packages can be used. Here we use the same dataset but

efficiently subset using a key xts feature and fed into CRAN package

rtsplot and requesting OHLC instead of line plot.

> rtsplot::rtsplot(gme["20210128"], main="GME on 2021-Jan-28", type="ohlc")If a vector of symbols is used in the query, a list of results is returned:

> res <- time_series(c("SPY", "QQQ", "IWM", "EEM"), outputsize=300, as="xts")

> op <- par(mfrow=c(2,2))

> sapply(res, function(x) quantmod::chart_Series(x, name=attr(x, "symbol")))

> par(op)As of version 0.0.2, additional get_quote() and get_price() accessors are available.

As of version 0.0.5, support for reference data has been added.

Still relatively, but already fairly feature-complete. The package is also officially recommended and approved by Twelve Data, but is developed independently. For an officially supported package, see their twelvedata-python package.

Any problem, bug report, or feature request for the package can be submitted and handled most conveniently as a Github issue in the repository.

Before submitting pull requests, it is frequently preferable to first discuss need and scope in such an issue ticket. See the file Contributing.md (in the Rcpp repo) for a brief discussion.

Dirk Eddelbuettel and Kenneth Rose

GPL (>= 2)