-

Notifications

You must be signed in to change notification settings - Fork 10

New issue

Have a question about this project? Sign up for a free GitHub account to open an issue and contact its maintainers and the community.

By clicking “Sign up for GitHub”, you agree to our terms of service and privacy statement. We’ll occasionally send you account related emails.

Already on GitHub? Sign in to your account

Reduce maker fee ratio and increase BSQ fees by 10% #181

Comments

|

I think this is an important suggestion. Why not encourage market making with lower maker fees? |

|

Even with the volatility experimented last days, numbers for the proposal would stay the same. |

|

It should be clarified here that the current and proposed maker and taker fees listed above are per bitcoin traded. For example, the current maker fees are 0.002 BTC / 10 BSQ per bitcoin, meaning that when making an offer to buy or sell 0.25 bitcoin, the maker fees are (0.002×0.25) 0.0005 BTC / (10*0.25) 2.5 BSQ. |

|

I updated the title of this proposal to fix a typo and to make it more explicit. I'm upvoting this because further incentivizing makers makes sense from the perspective of increasing liquidity. The 10% increase in overall fees makes sense to me as well, though I am generally uncomfortable with this kind of "ad-hoc" fee change. We need something more systematic and predictable, like what was proposed in #173. That proposal was ultimately downvoted, but we should take another shot at it based on the feedback provided, particularly with regard to putting a per-cycle / per-release cap in place, so that no one fee increase is too great a shock. There should at a minimum be a spreadsheet somewhere that codifies the formula, reflects what current rates are (in the app) and should be (in the next release). It will be important to show over time that fees go down as well as up based on this systematic approach. Could someone raise their hand here to own putting that spreadsheet and proposal together? I think the proposal will be much more actionable and likely to be approved if we have the spreadsheet in hand and everyone can review it and provide feedback on it ahead of voting time. Finally, I'm upvoting this with the assumption that we will make the change known in an effective manner to our audience of current and potential makers. @m52go, if this is approved, could you ensure that happens? |

|

I'm glad DAO accepted this proposal, I was worried because of lack of discussion.

The reason why a 10% increase was proposed is to make the fee increase smooth, but the idea is to consider as approved the #173 proposal. I'm not sure if the discount should be 50 or 40%, as both options were considered there, but it should be somewhere close to it, and using the 30 day average price to make it systematic and predictable. |

|

I have made this simple spreadsheet where everyone can review how BSQ discount is calculated. |

|

Closed as approved by DAO voting cycle 11 |

Proposal

This proposal aims to change Bisq DAO parameters for Maker and Taker fee for BTC and BSQ as displayed in the next tables:

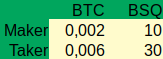

Current fees

Proposed fees

Maker fees were already reduced about a year ago, but I think Bisq should increase that reduction, maybe to a point where spam inhibition is the only reason to have that fee.

Motivation to reduce maker trading fees

Market makers at Bisq face extra costs and risks compared to takers and other exchanges. They have to:

Some exchanges already have zero or negative trading fees for market makers. This is impossible for Bisq, as trading fees is also a measure against network spam, but if these markets can even work with negative fees, we shouldn't fear to reduce by half market maker fees while taker fees are increased proportionally. Bisq is addressing their users to post offers to increase liquidity, and this proposal makes it easier for them.

Motivation to increase BSQ fees

BSQ fees are increased 10% to keep track of this proposal which was rejected because it supposed a drastic increase of BSQ fees in fiat terms. I think that the general idea of keeping BSQ fees at 50% discount of BTC was not rejected so Bisq should adjust BSQ fees to reach that goal.

In this proposal, at current prices (0.7 USD/BSQ), paying with BSQ suppose a discount of 53%, while now it's about a 60% discount. It's a steady fee increase that should not disturb traders very much.

This part of the proposal is subject to BSQ and BTC volatility. If there's general acceptance, DAO proposal with parameter changes will be submitted close to the end of proposal phase.

The text was updated successfully, but these errors were encountered: