-

Notifications

You must be signed in to change notification settings - Fork 16

New issue

Have a question about this project? Sign up for a free GitHub account to open an issue and contact its maintainers and the community.

By clicking “Sign up for GitHub”, you agree to our terms of service and privacy statement. We’ll occasionally send you account related emails.

Already on GitHub? Sign in to your account

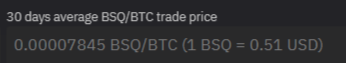

BSQ rate for Cycle 12 is 0.56 USD per 1 BSQ #519

Comments

|

I added a PR to calculate the volume weighted USD/BSQ price, which I think is the correct measure to use here. See screen shot. The average price over the last 90 days was USD0.56 per BSQ. |

|

I don't know exactly how this weighted average is calculated, but the sudden fall in BSQ price even using a 90 day average didn't look fair. 🤣 |

|

To explain a bit further why I did this. The current calculation is using the volume weighted average price of BSQ priced in BTC. This is a good measure for the average price of BSQ in BTC, but since we're not using BTC as our unit of account that doesn't really make sense. To just take the USD value of BTC at the end of the 90 days as the non weighted average price of BTC over that 90 day period is not a good measure of anything really. My change is doing the same as we currently do, but measured in USD rather than BTC. |

|

@ifarnung Indeed, it's not clear that using an average over 90 days is the best method. This change was just to use a correct measure. I support using a shorter look back period to calculate the price used for CRs. If we use any look back period it should be an average though in my opinion. Otherwise we might as well just use spot price at some point during the current cycle. For some kind of stability and to make it harder to manipulate I think it's better to use at least 30 days average. |

|

Agreed, for BSQ an average is great as there are many outlier BSQ trade prices due to both the order book system of BISQ (any offer can be taken without respecting best bid or best offer) and the generally low liquidity of the BSQ token. For BTC it's not clear to me that an average is necessary as at any given time there are millions and millions of $ of liquidity at any given moment, as well as no worry of manipulation of the BTC price. Thanks for taking the time to investigate the formula used and propose a fixed version! Let's see what others seem to think, if they care about this minutiae. 😂 |

|

If nobody is against it, tomorrow I will edit the title of this issue to use the weighted average price over the last 90 days: I'm in favour of using the 30 days instead of 90 as well, but as this is a bigger change, I'd rather implement it for Cycle 13. I think this also has implications for UI. The DAO wouldn't be using 90 day average for anything, so this metric could be removed and display just 30 days average. |

|

Changing to using a 30 day average should be its own proposal. If you think it important you can create one, I would support it unless there are some very good arguments against. |

|

Agree -- this change makes sense, so thanks for implementing. I'd also be in favor of a 30-day average. |

|

Just gave my 👍 here as well. Thanks @sqrrm for putting together the PR, and I agree with the change in the BSQ rate to reflect the weighted average. I'm uncertain about the move from 90 day to 30 day. Need to think about it more. |

|

90 days volume weighted average was used. |

At the start of cycle 11, the 90 days USD average price was 0.44. This is the recommended rate to be used for compensation on this cycle.

More info about the Compensation process at https://bisq.wiki/Compensation

The text was updated successfully, but these errors were encountered: