-

Notifications

You must be signed in to change notification settings - Fork 11

New issue

Have a question about this project? Sign up for a free GitHub account to open an issue and contact its maintainers and the community.

By clicking “Sign up for GitHub”, you agree to our terms of service and privacy statement. We’ll occasionally send you account related emails.

Already on GitHub? Sign in to your account

Litecoin LTC/BTC Volume Booster Bounty 500 $BSQ #178

Comments

|

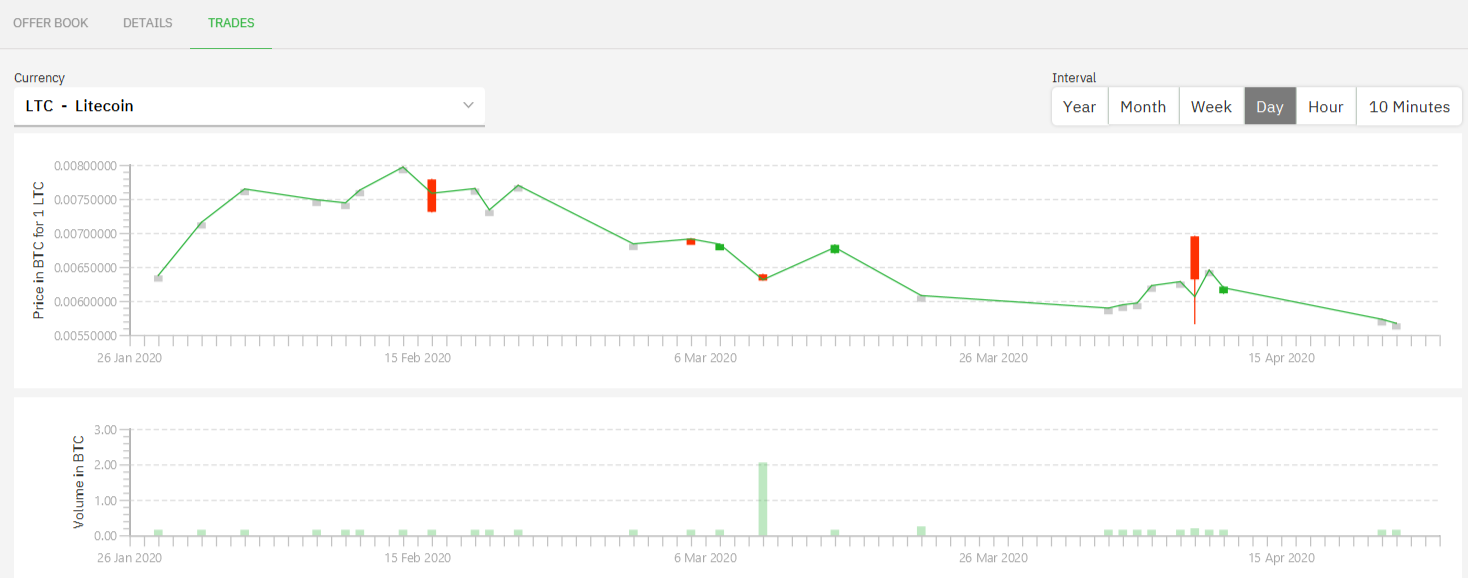

LTC/BTC is a very small market currently for Bisq. This bounty should be easy to win. Just attracting a handful of active traders will be enough to achieve the 50% increase in volume. However the lessons learned and feedback on how to do this will be very useful information to Bisq and an effective strategy could be replicated by contributors in other markets. |

|

LTC/BTC volume for the last 3 months was under 1 BTC. So on the one hand a 50% increase should be very easy to achieve for whoever wants to claim the bounty. On the other hand the 500 $BSQ will probably not be justified by extra fees generated for the DAO. However I do think this is worth it as an experiment. If it works there are other markets that this could be applied to. However if anyone feels that this bounty does not add value to the DAO I will be happy to review and change the amount of the reward. |

|

I claim the intention to collect this bounty. |

|

Hi @bounhun you have done step 1 - announced intention to claim the bounty. Now step 2: outline strategy... ...please describe here your strategy so that other DAO users can give you a thumbs up, discuss and ask questions. No need to give away any secrets or too much detail, just enough so that Bisq contributors can judge that you will make a worthwhile effort. If you start on February 1st the benchmark for success will be LTC/BTC volumes for the months of Nov-Dec-Jan vs volumes for Feb-Mar-Apr. Whatever we learn from your efforts will be very useful for future bounties, so your reporting here will be very good info for Bisq. |

|

First weeks I'll try keep offers online following a similar pattern to this: I'm not going to make any promotion other than a few forums where I'm already active at. I think Bisq needs volume to be appealing for traders, so I'm providing it. I'd like to start as soon as possible, but I agree the benchmark needs to be clear for all of us. |

|

I like this strategy, I believe that lack of liquidity is what drives most would-be traders away. However I'd like a few days to give other Bisq contributors an opportunity to object, ask questions and confirm that they agree to this bounty. |

|

No, I'm not. My max offer will be 0.25 btc at the beginning. I'm waiting for a clear benchmark and your OK. |

|

@bounhun anything in particular you're looking for with regard to benchmarks? It sound like you have a clear-enough strategy for making this market, as well as a plan to report progress. Otherwise this sounds like a worthy experiment to me, please go ahead. |

|

OK I start today then. |

Review:I've managed to have almost 24/7 the offers published with the with the previously proposed offer structure. New offer structureAll trades were for 1% and 0.01btc. I don't want to have many offers if they're not going to be taken, so I'm going to narrow spreads providing more volume at lower margins. This is the new offer structure: |

|

Review: Offers were posted with earlier proposed structure 24/7 and I think results are good. Offer structure No big changes, except big offers will be more attractive: 0.01 BTC at 0.8% (not always available) I don't like having unproductive offers: |

|

Review Offer structure Spreads are reduced again for big offers.

0.6, 0.1 and 0.25 offers will reduce 0.1% their spread daily until they reach the higher level. 0.015 offers won't be always available. |

|

This feedback is very much appreciated @bounhun it really helps narrow down what works and what doesn't for future initiatives... |

|

Review Offers have been available almost 24/7. There's been 5 trades for 0.1618 BTC, better than last period and similar to previous ones. All trades have been performed by me. Last Thursday, there was a 2BTC order for a few hours at fixed price, for around 1% that was not taken. Offer structure Prices are reduced again, some of this orders might be instant.

0.06, 0.1 and 0.25 reduces it's price 0.1% every day until reach higher level. Special prices will be offered on Thursdays, to Make the Market March. |

ReviewOffers have been available 24/7. There's been 4 trades for 2.076 BTC. As Flix noticed, there was a trade for 2.0 BTC that someone took from me while I was hesitant to take. It was a fixed price offer with something like 0.5% premium. I wish there were more like that and I'm glad someone took it, it means market is being watched and attractive offers don't stay for long. It's going to be a month with an offer in dispute because of future trading. The other part has been completely unresponsive, and arbitrator still made me wait for his response, and informed me that mediators don't share any info with him so everything has to be reviewed again. He told me that the other part has 3 days to answer. Since then, it's been 7 days with no answer from arbitrator, and soon will be a whole month with my funds locked in a trade without any technical issues. Offer structureOrders for this period might be chaotic depending on mining fees (small offers become unattractive), but this is a reference:

I might be offering 0.1 and 0.25 BTC orders at very low prices. Special prices will be offered on Thursdays, to Make the Market March. |

ReviewOnly one offer, but a big one. 0.25 BTC Order structureThis is the last month for the bounty, I'm already making orders very close to spot or at spot. Total volume in orders should be lower. |

ReviewOrders were there 24/7, except trading halt. There's been 12 trades for 0.509 BTC, best ever. Order structureKeeping all orders under 1% spot. |

ReviewEven with the lower prices ever, there have been just two trades for 0.12 BTC. There are other traders making orders but too expensive (+3%). Order structureKeeping all orders under 1% spot. |

|

Very nice progress! October 0.50 February 0.30 bounhun is well on his way to winning this bounty and achieving that 50% increase in volume. This market is not yet at the "there's trades every day" level... but at least now there are multiple trades performed every week. I would be very interested in seeing what bounhun's assessment is about future potential. |

|

Just 0.04 BTC have been traded in this period, in 4 orders and most of them not mine. Very annoying considering I'm offering spreads near 0 just to remove some liquidity stuck with LTC. About 3.4 BTC have been traded in the last 3 months. If we remove the 2BTC trade on 10th March, it's 1.4 BTC. An increase considering earlier periods, not a big one, but the proportion with ETH makes sense (last 24 hour volume for ETH is 4 times higher than LTC). I will keep the same orders until the end of this DAO period and later it will be reduced, but my intention is to keep doing this market making as long as there's interest on this coin. For more detailed info about the bounty, read ETH final report because conclusions are similar. |

|

May was a good month, with 13 trades for 0.951 BTC. June has 2 trades for 0.07 BTC only. |

|

June had four trades, for 0.18 BTC. I'm glad July ishaving good numbers (7 trades for 0.78BC) even when I stopped trading from 2nd July to 17th. I expose on the ETH thread the reasons why I want to make the bounty request again. #177 (comment) |

Litecoin LTC/BTC Volume Booster Bounty

The goal of this bounty is to increase LTC/BTC trading volume.

To claim this bounty a contributor must outline and execute a strategy over a 3 month period to attract traders and increase volume traded in the LTC/BTC market by 50%.

https://bisq.network/markets/?currency=ltc_btc

Declare intention to claim bounty

Outline strategy

Report on progress and detail work done here

IF volume over the 3 month period following the start of contributors work is 50% higher than the 3 months preceding THEN the contributor can claim the bounty.

Bounty: 500 $BSQ

The text was updated successfully, but these errors were encountered: