_symbol = AddEquity("SPY", dataNormalizationMode: DataNormalizationMode.Raw).Symbol;

diff --git a/03 Writing Algorithms/03 Securities/99 Asset Classes/01 US Equity/02 Handling Data/03 Trades.php b/03 Writing Algorithms/03 Securities/99 Asset Classes/01 US Equity/02 Handling Data/03 Trades.php

index 189ac2a321..b042aa583f 100644

--- a/03 Writing Algorithms/03 Securities/99 Asset Classes/01 US Equity/02 Handling Data/03 Trades.php

+++ b/03 Writing Algorithms/03 Securities/99 Asset Classes/01 US Equity/02 Handling Data/03 Trades.php

@@ -1,6 +1,6 @@

-

diff --git a/03 Writing Algorithms/03 Securities/99 Asset Classes/01 US Equity/02 Handling Data/04 Quotes.php b/03 Writing Algorithms/03 Securities/99 Asset Classes/01 US Equity/02 Handling Data/04 Quotes.php

index 93b3dab182..666557a64e 100644

--- a/03 Writing Algorithms/03 Securities/99 Asset Classes/01 US Equity/02 Handling Data/04 Quotes.php

+++ b/03 Writing Algorithms/03 Securities/99 Asset Classes/01 US Equity/02 Handling Data/04 Quotes.php

@@ -1,6 +1,6 @@

-

diff --git a/03 Writing Algorithms/03 Securities/99 Asset Classes/01 US Equity/02 Handling Data/05 Ticks.php b/03 Writing Algorithms/03 Securities/99 Asset Classes/01 US Equity/02 Handling Data/05 Ticks.php

index b10d5d3f84..a806ba1574 100644

--- a/03 Writing Algorithms/03 Securities/99 Asset Classes/01 US Equity/02 Handling Data/05 Ticks.php

+++ b/03 Writing Algorithms/03 Securities/99 Asset Classes/01 US Equity/02 Handling Data/05 Ticks.php

@@ -1,8 +1,8 @@

-

-If we detect a tick that may be suspicious, we set its Suspicious flag to true.

If we detect a tick that may be suspicious, we set its Suspicioussuspicious flag to true.

To set the data normalization mode for a security, pass a dataNormalizationMode argument to the AddEquityadd_equity method..

To set the data normalization mode for a security, pass a dataNormalizationModedata_normalization_mode argument to the AddEquityadd_equity method..

_symbol = AddEquity("YESBANK", market: Market.India, dataNormalizationMode: DataNormalizationMode.Raw).Symbol;

diff --git a/03 Writing Algorithms/03 Securities/99 Asset Classes/02 India Equity/02 Handling Data/02 Trades.php b/03 Writing Algorithms/03 Securities/99 Asset Classes/02 India Equity/02 Handling Data/02 Trades.php

index 463b186243..bb4d771a89 100644

--- a/03 Writing Algorithms/03 Securities/99 Asset Classes/02 India Equity/02 Handling Data/02 Trades.php

+++ b/03 Writing Algorithms/03 Securities/99 Asset Classes/02 India Equity/02 Handling Data/02 Trades.php

@@ -1,6 +1,6 @@

-

diff --git a/03 Writing Algorithms/03 Securities/99 Asset Classes/03 Equity Options/02 Handling Data/02 Trades.php b/03 Writing Algorithms/03 Securities/99 Asset Classes/03 Equity Options/02 Handling Data/02 Trades.php

index 7773ac7281..fcc18f8cfd 100644

--- a/03 Writing Algorithms/03 Securities/99 Asset Classes/03 Equity Options/02 Handling Data/02 Trades.php

+++ b/03 Writing Algorithms/03 Securities/99 Asset Classes/03 Equity Options/02 Handling Data/02 Trades.php

@@ -1,4 +1,4 @@

-

diff --git a/03 Writing Algorithms/03 Securities/99 Asset Classes/04 Crypto/02 Handling Data/04 Quotes.php b/03 Writing Algorithms/03 Securities/99 Asset Classes/04 Crypto/02 Handling Data/04 Quotes.php

index 93b3dab182..2e33e917e5 100644

--- a/03 Writing Algorithms/03 Securities/99 Asset Classes/04 Crypto/02 Handling Data/04 Quotes.php

+++ b/03 Writing Algorithms/03 Securities/99 Asset Classes/04 Crypto/02 Handling Data/04 Quotes.php

@@ -1,6 +1,6 @@

-

diff --git a/03 Writing Algorithms/03 Securities/99 Asset Classes/04 Crypto/02 Handling Data/05 Ticks.php b/03 Writing Algorithms/03 Securities/99 Asset Classes/04 Crypto/02 Handling Data/05 Ticks.php

index 0595f8a481..fdc6307f66 100644

--- a/03 Writing Algorithms/03 Securities/99 Asset Classes/04 Crypto/02 Handling Data/05 Ticks.php

+++ b/03 Writing Algorithms/03 Securities/99 Asset Classes/04 Crypto/02 Handling Data/05 Ticks.php

@@ -1,6 +1,6 @@

-

diff --git a/03 Writing Algorithms/03 Securities/99 Asset Classes/05 Crypto Futures/02 Handling Data/03 Trades.php b/03 Writing Algorithms/03 Securities/99 Asset Classes/05 Crypto Futures/02 Handling Data/03 Trades.php

index 463b186243..bb4d771a89 100644

--- a/03 Writing Algorithms/03 Securities/99 Asset Classes/05 Crypto Futures/02 Handling Data/03 Trades.php

+++ b/03 Writing Algorithms/03 Securities/99 Asset Classes/05 Crypto Futures/02 Handling Data/03 Trades.php

@@ -1,6 +1,6 @@

-

diff --git a/03 Writing Algorithms/03 Securities/99 Asset Classes/05 Crypto Futures/02 Handling Data/04 Quotes.php b/03 Writing Algorithms/03 Securities/99 Asset Classes/05 Crypto Futures/02 Handling Data/04 Quotes.php

index 93b3dab182..2e33e917e5 100644

--- a/03 Writing Algorithms/03 Securities/99 Asset Classes/05 Crypto Futures/02 Handling Data/04 Quotes.php

+++ b/03 Writing Algorithms/03 Securities/99 Asset Classes/05 Crypto Futures/02 Handling Data/04 Quotes.php

@@ -1,6 +1,6 @@

-

diff --git a/03 Writing Algorithms/03 Securities/99 Asset Classes/05 Crypto Futures/02 Handling Data/05 Ticks.php b/03 Writing Algorithms/03 Securities/99 Asset Classes/05 Crypto Futures/02 Handling Data/05 Ticks.php

index 0595f8a481..fdc6307f66 100644

--- a/03 Writing Algorithms/03 Securities/99 Asset Classes/05 Crypto Futures/02 Handling Data/05 Ticks.php

+++ b/03 Writing Algorithms/03 Securities/99 Asset Classes/05 Crypto Futures/02 Handling Data/05 Ticks.php

@@ -1,6 +1,6 @@

-

diff --git a/03 Writing Algorithms/03 Securities/99 Asset Classes/06 Forex/02 Handling Data/02 Quotes.php b/03 Writing Algorithms/03 Securities/99 Asset Classes/06 Forex/02 Handling Data/02 Quotes.php

index 61f87f4a81..e09a71be8a 100644

--- a/03 Writing Algorithms/03 Securities/99 Asset Classes/06 Forex/02 Handling Data/02 Quotes.php

+++ b/03 Writing Algorithms/03 Securities/99 Asset Classes/06 Forex/02 Handling Data/02 Quotes.php

@@ -1,6 +1,6 @@

-

diff --git a/03 Writing Algorithms/03 Securities/99 Asset Classes/06 Forex/02 Handling Data/03 Ticks.php b/03 Writing Algorithms/03 Securities/99 Asset Classes/06 Forex/02 Handling Data/03 Ticks.php

index a19ed9e28b..12eca6b287 100644

--- a/03 Writing Algorithms/03 Securities/99 Asset Classes/06 Forex/02 Handling Data/03 Ticks.php

+++ b/03 Writing Algorithms/03 Securities/99 Asset Classes/06 Forex/02 Handling Data/03 Ticks.php

@@ -1,6 +1,6 @@

-

diff --git a/03 Writing Algorithms/03 Securities/99 Asset Classes/07 Futures/02 Handling Data/02 Trades.php b/03 Writing Algorithms/03 Securities/99 Asset Classes/07 Futures/02 Handling Data/02 Trades.php

index 7773ac7281..fcc18f8cfd 100644

--- a/03 Writing Algorithms/03 Securities/99 Asset Classes/07 Futures/02 Handling Data/02 Trades.php

+++ b/03 Writing Algorithms/03 Securities/99 Asset Classes/07 Futures/02 Handling Data/02 Trades.php

@@ -1,4 +1,4 @@

-Tick objects represent a price for the Index at a moment in time. Tick objects have the following properties:

-Index ticks have a non-zero value for the Price property, but they have a zero value for the BidPrice, BidSize, AskPrice, and AskSize properties.

Index ticks have a non-zero value for the Priceprice property, but they have a zero value for the BidPricebid_price, BidSizebid_size, AskPriceask_price, and AskSizeask_size properties.

In backtests, LEAN groups ticks into one millisecond buckets. In live trading, LEAN groups ticks into ~70-millisecond buckets. To get the Tick objects in the Slice, index the Ticks property of the Slice with a Symbol. The Slice may not contain data for your Symbol at every time step. To avoid issues, check if the Slice contains data for your Index before you index the Slice with the Index Symbol.

Futures

-In the case of Futures, the data normalization mode affects how historical data of two contracts is stitched together to form the continuous contract. To view all the available options, see Data Normalization. The default value is DataNormalizationMode.Adjusted. To change the data normalization mode, in the Initialize method, pass a dataNormalizationMode argument to the AddFutureadd_future method.

In the case of Futures, the data normalization mode affects how historical data of two contracts is stitched together to form the continuous contract. To view all the available options, see Data Normalization. The default value is DataNormalizationMode.Adjusted. To change the data normalization mode, in the Initialize method, pass a dataNormalizationModedata_normalization_mode argument to the AddFutureadd_future method.

AddFuture(Futures.Currencies.BTC, dataNormalizationMode: DataNormalizationMode.BackwardsRatio);diff --git a/03 Writing Algorithms/12 Universes/04 Equity Options/02 Create Universes.php b/03 Writing Algorithms/12 Universes/04 Equity Options/02 Create Universes.php index c41859c7f9..ca0c53b7a1 100644 --- a/03 Writing Algorithms/12 Universes/04 Equity Options/02 Create Universes.php +++ b/03 Writing Algorithms/12 Universes/04 Equity Options/02 Create Universes.php @@ -89,7 +89,7 @@ -

If you already have a subscription to the underlying Equity but it's not Raw data normalization, LEAN automatically changes it to Raw.

If you already have a subscription to the underlying Equity but it's not RawRAW data normalization, LEAN automatically changes it to RawRAW.

To override the default pricing model of the Option, set a pricing model.

diff --git a/03 Writing Algorithms/12 Universes/06 Futures/11 Create Universes.html b/03 Writing Algorithms/12 Universes/06 Futures/11 Create Universes.html index 3f9e7228a1..8cd78eae74 100644 --- a/03 Writing Algorithms/12 Universes/06 Futures/11 Create Universes.html +++ b/03 Writing Algorithms/12 Universes/06 Futures/11 Create Universes.html @@ -63,7 +63,7 @@Argument: dataMappingMode

Argument: dataNormalizationMode

+ Argument: dataNormalizationModedata_normalization_mode

The price scaling mode to use for the continuous future contract

Data Type: DataNormalizationMode?DataNormalizationMode/NoneType | Default Value: Nonenull

To configure how LEAN identifies the current Future contract in the continuous series and how it forms the adjusted price between each contract, provide dataMappingMode, dataNormalizationMode, and contractDepthOffset arguments to the AddFutureadd_future method. The Future object that the AddFutureadd_future method returns contains a Mapped property that references the current contract in the continuous contract series. As the contracts roll over, the Mapped property references the next contract in the series and you receive a SymbolChangedEvent object in the OnDataon_data method. The SymbolChangedEvent references the old contract Symbol and the new contract Symbol. You can use SymbolChangedEvents to roll over contracts.

To configure how LEAN identifies the current Future contract in the continuous series and how it forms the adjusted price between each contract, provide dataMappingMode, dataNormalizationModedata_normalization_mode, and contractDepthOffset arguments to the AddFutureadd_future method. The Future object that the AddFutureadd_future method returns contains a Mapped property that references the current contract in the continuous contract series. As the contracts roll over, the Mapped property references the next contract in the series and you receive a SymbolChangedEvent object in the OnDataon_data method. The SymbolChangedEvent references the old contract Symbol and the new contract Symbol. You can use SymbolChangedEvents to roll over contracts.

public override void OnData(Slice slice) @@ -47,7 +47,7 @@In backtesting, the

SymbolChangedEventoccurs at midnight Eastern Time (ET). In live trading, the live data for continuous contract mapping arrives at 6/7 AM ET, so that's when it occurs.Data Normalization Modes

-The

+dataNormalizationModeargument defines how the price series of two contracts are stitched together when the contract rollovers occur. The followingDataNormalizatoinModeenumeration members are available for continuous contracts:The

dataNormalizationModedata_normalization_modeargument defines how the price series of two contracts are stitched together when the contract rollovers occur. The followingDataNormalizatoinModeenumeration members are available for continuous contracts:We use the entire Futures history to adjust historical prices. This process ensures you get the same adjusted prices, regardless of the backtest end date.

diff --git a/03 Writing Algorithms/28 Indicators/02 Key Concepts/10 Reset Indicators.html b/03 Writing Algorithms/28 Indicators/02 Key Concepts/10 Reset Indicators.html index 66fbbfdd1f..347b0cae96 100644 --- a/03 Writing Algorithms/28 Indicators/02 Key Concepts/10 Reset Indicators.html +++ b/03 Writing Algorithms/28 Indicators/02 Key Concepts/10 Reset Indicators.html @@ -11,7 +11,7 @@ If you are live trading Equities or backtesting Equities without the adjusted data normalization mode, reset your indicators when splits and dividends occur. If a split or dividend occurs, the data in your indicators becomes invalid because it doesn't account for the price adjustments that the split or dividend causes. - To replace your indicator history with the newly-adjusted prices, call theResetmethod and then warm up the indicator withScaledRawdata from a history request. + To replace your indicator history with the newly-adjusted prices, call theResetmethod and then warm up the indicator withScaledRawSCALED_RAWdata from a history request.diff --git a/03 Writing Algorithms/34 Algorithm Framework/03 Alpha/01 Key Concepts/06 Insights.html b/03 Writing Algorithms/34 Algorithm Framework/03 Alpha/01 Key Concepts/06 Insights.html index fbc9cd5002..f27cfebf49 100644 --- a/03 Writing Algorithms/34 Algorithm Framework/03 Alpha/01 Key Concepts/06 Insights.html +++ b/03 Writing Algorithms/34 Algorithm Framework/03 Alpha/01 Key Concepts/06 Insights.html @@ -33,7 +33,7 @@-Create Insights

var insight = Insight.Price("IBM", Resolution.Minute, 20, InsightDirection.Up);In the

+Pricemethod, theperiodargument can be atimedeltaTimeSpanobject, aDateTimedatetimeobject, or a function that receives aDateTimedatetimeobject and returns the expiryDateTimedatetime.In the

Pricepricemethod, theperiodargument can be atimedeltaTimeSpanobject, aDateTimedatetimeobject, or a function that receives aDateTimedatetimeobject and returns the expiryDateTimedatetime.Group Insights

Sometimes an algorithm's performance relies on multiple insights being traded together, like in pairs trading and options straddles. These types insights should be grouped. Insight groups signal to the Execution model that the insights need to be acted on as a single unit to maximize the alpha created.

diff --git a/04 Research Environment/03 Datasets/04 US Equity/07 Data Normalization.php b/04 Research Environment/03 Datasets/04 US Equity/07 Data Normalization.php index 106d5e5359..03642d7038 100644 --- a/04 Research Environment/03 Datasets/04 US Equity/07 Data Normalization.php +++ b/04 Research Environment/03 Datasets/04 US Equity/07 Data Normalization.php @@ -5,7 +5,7 @@ include(DOCS_RESOURCES."/securities/data-normalization.php"); ?> -When you request historical data, the

+Historyhistorymethod uses the data normalization of your security subscription. To get historical data with a different data normalization, pass adataNormalizationModeargument to theHistoryhistorymethod.When you request historical data, the

Historyhistorymethod uses the data normalization of your security subscription. To get historical data with a different data normalization, pass adataNormalizationModedata_normalization_modeargument to theHistoryhistorymethod.var history = qb.History(qb.Securities.Keys, qb.Time-TimeSpan.FromDays(10), qb.Time, dataNormalizationMode: DataNormalizationMode.SplitAdjusted);history = qb.history(qb.securities.keys, qb.time-timedelta(days=10), qb.time, dataNormalizationMode=DataNormalizationMode.SPLIT_ADJUSTED)diff --git a/04 Research Environment/03 Datasets/12 Futures/03 Create Subscriptions.php b/04 Research Environment/03 Datasets/12 Futures/03 Create Subscriptions.php index f11d4c6685..3b4e31e078 100644 --- a/04 Research Environment/03 Datasets/12 Futures/03 Create Subscriptions.php +++ b/04 Research Environment/03 Datasets/12 Futures/03 Create Subscriptions.php @@ -37,7 +37,7 @@Resolution.MinuteResolution.MINUTE

dataNormalizationModedataNormalizationModedata_normalization_modeDataNormalizationMode.Adjusted2023-10-09

2023-10-06

- Added Cloud Platform > Projects > Files > Encrypt Files -

- Updated Writing Algorithms > Indicators > Key Conecpts > Reset Indicators to include an example of using

ScaledRawdata

+ - Updated Writing Algorithms > Indicators > Key Conecpts > Reset Indicators to include an example of using

ScaledRawSCALED_RAWdata - Added the following pages/sections for short availability:

- Writing Algorithms > Reality Modeling > Short Availability > Key Concepts diff --git a/Resources/datasets/data-normalization.php b/Resources/datasets/data-normalization.php index b762b55209..9255153386 100644 --- a/Resources/datasets/data-normalization.php +++ b/Resources/datasets/data-normalization.php @@ -1,6 +1,6 @@ -

If you use Adjusted, SplitAdjusted, or TotalReturn, we use the entire split and dividend history to adjust historical prices. This process ensures you get the same adjusted prices, regardless of the

+

If you use AdjustedADJUSTED, SplitAdjustedSPLIT_ADJUSTED, or TotalReturnTOTAL_RETURN, we use the entire split and dividend history to adjust historical prices. This process ensures you get the same adjusted prices, regardless of the

- backtest end date. The ScaledRaw data normalization is only for history requests. When you use ScaledRaw, we use the split and dividend history before the algorithm's current time to adjust historical prices. The ScaledRaw data normalization model enables you to warm up indicators with adjusted data when you subscribe to Raw security data.

ScaledRawSCALED_RAW data normalization is only for history requests. When you use ScaledRawSCALED_RAW, we use the split and dividend history before the algorithm's current time to adjust historical prices. The ScaledRawSCALED_RAW data normalization model enables you to warm up indicators with adjusted data when you subscribe to RawRAW security data.

- QuantBook time. If you use ScaledRaw, we use the split and dividend history before the QuantBook's EndDate to adjust historical prices.

+ QuantBook time. If you use ScaledRawSCALED_RAW, we use the split and dividend history before the QuantBook's EndDate to adjust historical prices.

\ No newline at end of file

diff --git a/Resources/datasets/request-data.php b/Resources/datasets/request-data.php

index 02ab402ecc..0ed9e7b394 100644

--- a/Resources/datasets/request-data.php

+++ b/Resources/datasets/request-data.php

@@ -406,7 +406,7 @@

nullNonedataNormalizationModedataNormalizationModedata_normalization_modeDataNormalizationMode?DataNormalizationMode/NoneTypenullNoneA dividend is a payment that a company gives to shareholders to distribute profits. When a dividend payment occurs for an Equity in your algorithm, LEAN sends a Dividend object to the OnDataon_data method. Dividend objects have the following properties:

If you backtest with the Adjusted or TotalReturn data normalization mode, the dividends are factored into the price. If you backtest with the other data normalization modes or trade live, when a dividend payment occurs, LEAN automatically adds the payment amount to your cashbook. If you have indicators in your algorithm, reset and warm-up your indicators with ScaledRaw data when dividend payments occur so that the data in your indicators account for the price adjustments that the dividend causes.

If you backtest with the AdjustedADJUSTED or TotalReturnTOTAL_RETURN data normalization mode, the dividends are factored into the price. If you backtest with the other data normalization modes or trade live, when a dividend payment occurs, LEAN automatically adds the payment amount to your cashbook. If you have indicators in your algorithm, reset and warm-up your indicators with ScaledRaw data when dividend payments occur so that the data in your indicators account for the price adjustments that the dividend causes.

To get the Dividend objects, index the Dividends object with the security Symbol. The Dividends object may not contain data for your Symbol. To avoid issues, check if the Dividends object contains data for your security before you index it with the security Symbol.

You receive Split objects when a split is in the near future and when it occurs. To know if the split occurs in the near future or now, check the Type property.

If you backtest without the Raw data normalization mode, the splits are factored into the price and volume. If you backtest with the Raw data normalization mode or trade live, when a split occurs, LEAN automatically adjusts your positions based on the SplitFactor. If the post-split quantity isn't a valid lot size, LEAN credits the remaining value to your cashbook in your account currency. If you have indicators in your algorithm, reset and warm-up your indicators with ScaledRaw data when splits occur so that the data in your indicators account for the price adjustments that the splits cause.

If you backtest without the RawRAW data normalization mode, the splits are factored into the price and volume. If you backtest with the RawRAW data normalization mode or trade live, when a split occurs, LEAN automatically adjusts your positions based on the SplitFactor. If the post-split quantity isn't a valid lot size, LEAN credits the remaining value to your cashbook in your account currency. If you have indicators in your algorithm, reset and warm-up your indicators with ScaledRaw data when splits occur so that the data in your indicators account for the price adjustments that the splits cause.

To get the Split objects, index the Splits object with the security Symbol. The Splits object may not contain data for your Symbol. To avoid issues, check if the Splits object contains data for your security before you index it with the security Symbol.

To set the data normalization mode for a security, pass a dataNormalizationMode argument to the AddEquityadd_equity method.

To set the data normalization mode for a security, pass a dataNormalizationModedata_normalization_mode argument to the AddEquityadd_equity method.

var = AddEquity("", dataNormalizationMode: DataNormalizationMode.Raw).Symbol;

diff --git a/Resources/securities/quotebar.php b/Resources/securities/quotebar.php

index f99e7d6dd4..11facb2ad5 100644

--- a/Resources/securities/quotebar.php

+++ b/Resources/securities/quotebar.php

@@ -1,11 +1,11 @@

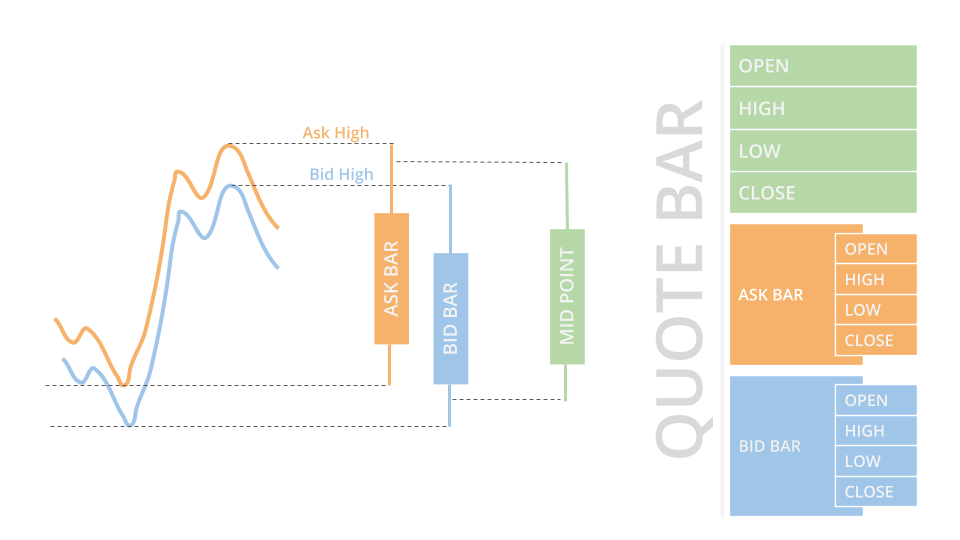

-QuoteBar objects are bars that consolidate NBBO quotes from the exchanges. They contain the open, high, low, and close prices of the bid and ask. The Open, High, Low, and Close properties of the QuoteBar object are the mean of the respective bid and ask prices. If the bid or ask portion of the QuoteBar has no data, the Open, High, Low, and Close properties of the QuoteBar copy the values of either the Bid or Ask instead of taking their mean.

QuoteBar objects are bars that consolidate NBBO quotes from the exchanges. They contain the open, high, low, and close prices of the bid and ask. The Openopen, Highhigh, Lowlow, and Closeclose properties of the QuoteBar object are the mean of the respective bid and ask prices. If the bid or ask portion of the QuoteBar has no data, the Openopen, Highhigh, Lowlow, and Closeclose properties of the QuoteBar copy the values of either the Bidbid or askask instead of taking their mean.

QuoteBar objects have the following properties:

To get the QuoteBar objects in the Slice, index the QuoteBars property of the Slice with the Symbol. If the doesn't actively get quotes or you are in the same time step as when you added the subscription, the Slice may not contain data for your Symbol. To avoid issues, check if the Slice contains data for your before you index the Slice with the Symbol.

To get the QuoteBar objects in the Slice, index the QuoteBars property of the Slice with the Symbolsymbol. If the doesn't actively get quotes or you are in the same time step as when you added the subscription, the Slice may not contain data for your Symbolsymbol. To avoid issues, check if the Slice contains data for your before you index the Slice with the Symbolsymbol.

public override void OnData(Slice slice)

@@ -16,9 +16,9 @@

}

}

- def OnData(self, slice: Slice) -> None: - if in slice.QuoteBars: - quote_bar = slice.QuoteBars[]+

def on_data(self, slice: Slice) -> None: + if in slice.quote_bars: + quote_bar = slice.quote_bars[]

You can also iterate through the QuoteBars dictionary. The keys of the dictionary are the Symbol objects and the values are the QuoteBar objects.

def OnData(self, slice: Slice) -> None: - for symbol, quote_bar in slice.QuoteBars.items(): - ask_price = quote_bar.Ask.Close+

def on_data(self, slice: Slice) -> None: + for symbol, quote_bar in slice.quote_bars.items(): + ask_price = quote_bar.ask.close

QuoteBar objects let LEAN incorporate spread costs into your simulated trade fills to make backtest results more realistic.

QuoteBar objects let LEAN incorporate spread costs into your simulated trade fills to make backtest results more realistic.

Tick objects represent a single trade or quote at a moment in time. A trade tick is a record of a transaction for the . A quote tick is an offer to buy or sell the at a specific price. Tick objects have the following properties:

Trade ticks have a non-zero value for the Quantity and Price properties, but they have a zero value for the BidPrice, BidSize, AskPrice, and AskSize properties. Quote ticks have non-zero values for BidPrice and BidSize properties or have non-zero values for AskPrice and AskSize properties. To check if a tick is a trade or a quote, use the TickType property.

Trade ticks have a non-zero value for the Quantityquantity and Priceprice properties, but they have a zero value for the BidPricebid_price, BidSizebid_size, AskPriceask_price, and AskSizeask_size properties. Quote ticks have non-zero values for BidPricebid_price and BidSizebid_size properties or have non-zero values for AskPriceask_price and AskSizeask_size properties. To check if a tick is a trade or a quote, use the TickTypeticktype property.

In backtests, LEAN groups ticks into one millisecond buckets. In live trading, LEAN groups ticks into ~70-millisecond buckets. To get the Tick objects in the Slice, index the Ticks property of the Slice with a Symbol. If the doesn't actively trade or you are in the same time step as when you added the subscription, the Slice may not contain data for your Symbol. To avoid issues, check if the Slice contains data for your before you index the Slice with the Symbol.

In backtests, LEAN groups ticks into one millisecond buckets. In live trading, LEAN groups ticks into ~70-millisecond buckets. To get the Tick objects in the Slice, index the Ticks property of the Slice with a Symbolsymbol. If the doesn't actively trade or you are in the same time step as when you added the subscription, the Slice may not contain data for your Symbolsymbol. To avoid issues, check if the Slice contains data for your before you index the Slice with the Symbolsymbol.

public override void OnData(Slice slice)

@@ -18,11 +18,11 @@

}

}

- def OnData(self, slice: Slice) -> None:

- if in slice.Ticks:

- ticks = slice.Ticks[]

+ def on_data(self, slice: Slice) -> None:

+ if in slice.ticks:

+ ticks = slice.ticks[]

for tick in ticks:

- price = tick.Price

+ price = tick.price

You can also iterate through the Ticks dictionary. The keys of the dictionary are the Symbol objects and the values are the List<Tick>list[Tick] objects.

def OnData(self, slice: Slice) -> None:

- for symbol, ticks in slice.Ticks.items():

+ def on_data(self, slice: Slice) -> None:

+ for symbol, ticks in slice.ticks.items():

for tick in ticks:

- price = tick.Price

+ price = tick.price

Tick data is raw and unfiltered, so it can contain bad ticks that skew your trade results. For example, some ticks come from dark pools, which aren't tradable. We recommend you only use tick data if you understand the risks and are able to perform your own online tick filtering.

\ No newline at end of file diff --git a/Resources/securities/tradebar.php b/Resources/securities/tradebar.php index e334db04ae..afe630898b 100644 --- a/Resources/securities/tradebar.php +++ b/Resources/securities/tradebar.php @@ -2,7 +2,7 @@

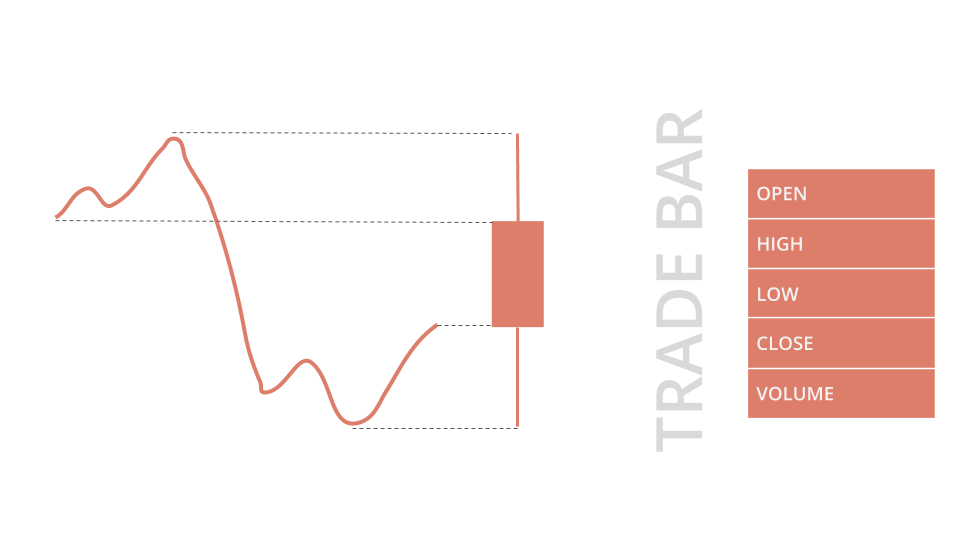

TradeBar objects have the following properties:

To get the TradeBar objects in the Slice, index the Slice or index the Barsbars property of the Slice with the Symbol. If the doesn't actively trade or you are in the same time step as when you added the subscription, the Slice may not contain data for your Symbol. To avoid issues, check if the Slice contains data for your before you index the Slice with the Symbol.

To get the TradeBar objects in the Slice, index the Slice or index the Barsbars property of the Slice with the Symbolsymbol. If the doesn't actively trade or you are in the same time step as when you added the subscription, the Slice may not contain data for your Symbolsymbol. To avoid issues, check if the Slice contains data for your before you index the Slice with the Symbolsymbol.

public override void OnData(Slice slice)

@@ -13,9 +13,8 @@

}

}

- def OnData(self, slice: Slice) -> None: - if in slice.Bars: - trade_bar = slice.Bars[]+

def on_data(self, slice: Slice) -> None: + trade_bar = slice.bars.get() # None if not found

def OnData(self, slice: Slice) -> None: - for symbol, trade_bar in slice.Bars.items(): - close_price = trade_bar.Close+ for symbol, trade_bar in slice.bars.items(): + close_price = trade_bar.close \ No newline at end of file diff --git a/code-generators/enum-table-generator.py b/code-generators/enum-table-generator.py index 826cb4610c..779e35e83c 100644 --- a/code-generators/enum-table-generator.py +++ b/code-generators/enum-table-generator.py @@ -186,9 +186,8 @@ def HtmlGeneration(obj_name, sorted_obj, extra=''): items = [y[0] for y in market if y[1] == x] items = [y[0] for y in market_data if y[0].lower() in items] items = [y for y in items if y.lower() not in ["ftx", "ftxus", "fxcm", "gdax"]] - + items = set(items + [x for x in items]) with open(f"{destination}/market-{x}.html", "w", encoding="utf-8") as file: x = "Futures" if x == "future" else x file.write(f"""

The following Market enumeration members are available for {x.title().replace("Option", "Options").replace("option", " Options").replace("Index", "Indices").replace("Indices Options", "Index Options")}: