bybit-backtest is a python library for backtest with bybit fx trade on Python 3.7 and above.

backtest data from here

$ pip install bybit-backtest

from bybit_backtest import Backtest

class MyBacktest(Backtest):

def strategy(self):

fast_ma = self.sma(period=5)

slow_ma = self.sma(period=25)

# golden cross

self.sell_exit = self.buy_entry = (fast_ma > slow_ma) & (

fast_ma.shift() <= slow_ma.shift()

)

# dead cross

self.buy_exit = self.sell_entry = (fast_ma < slow_ma) & (

fast_ma.shift() >= slow_ma.shift()

)

MyBacktest().run()from bybit_backtest import Backtest

class MyBacktest(Backtest):

def strategy(self):

rsi = self.rsi(period=10)

ema = self.ema(period=20)

lower = ema - (ema * 0.001)

upper = ema + (ema * 0.001)

self.buy_entry = (rsi < 30) & (self.df.C < lower)

self.sell_entry = (rsi > 70) & (self.df.C > upper)

self.sell_exit = ema > self.df.C

self.buy_exit = ema < self.df.C

self.qty = 0.1 # order quantity (default=0.001)

self.stop_loss = 50 # stop loss (default=0 stop loss none)

self.take_profit = 100 # take profit (default=0 take profit none)

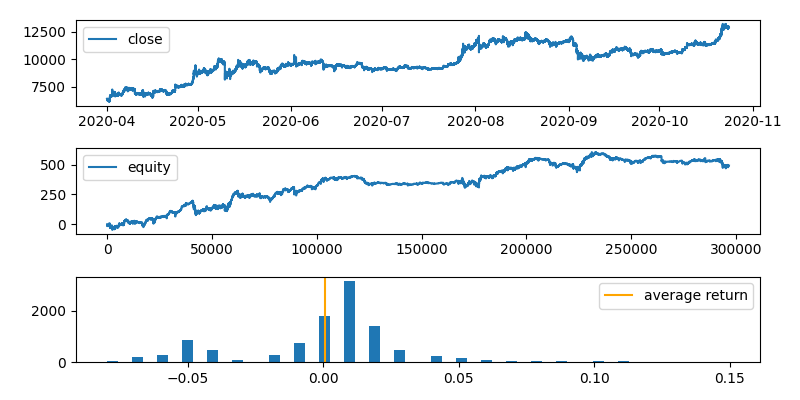

MyBacktest(

symbol="BTCUSD", # default=BTCUSD

sqlite_file_name="backtest.sqlite3", # (default=backtest.sqlite3)

from_date="2020-04-01", # (default="")

to_date="2020-10-25", # (default="")

interval="1T", # 5-60S(second), 1-60T(minute), 1-24H(hour) (default=1T)

download_data_dir="data", # download data directory (default=data)

).run("backtest.png")total profit 491.800

total trades 10309.000

win rate 65.700

profit factor 1.047

maximum drawdown 135.500

recovery factor 3.630

riskreward ratio 0.551

sharpe ratio 0.020

average return 0.001

stop loss 1779.000

take profit 93.000- Simple Moving Average 'sma'

- Exponential Moving Average 'ema'

- Moving Average Convergence Divergence 'macd'

- Relative Strenght Index 'rsi'

- Bollinger Bands 'bbands'

- Stochastic Oscillator 'stoch'

For help getting started with Bybit APIs and Websocket, view our online documentation.